2010

2011

2012

2012 July2013

2013 May2014

2014 April2014 February2014 November2015

2015 December2016

2016 December2017

2017 November2017 October2018

2018 April2019

2019 December2019 November2020

2020 June2020 March2021

2022

2023

2024

2025

2026

2027

2028

2029

2030

2031

2032

2033

2034

2035

Trinity Investment Management Founded

Trinity started with a vision to become a leading operating partner within UK real estate.

Founded by two former colleages Richard O’Boyle and Simon Hoad, with a vision of disrupting the UK real estate market.

From our humble beginnings in shared office space, we have grown exponentially managing an eclectic mix of assets across the UK and Ireland.

Anglia Retail Park Acquisition

Accquired Anglia Retail Park in Joint Venture with Starwood Capital.

Tenure: Freehold

Site Area: 16.9 Acres

Site Cover: 29%

Size: 218,760

- Bulky good & DIY only with 10% food allowance

- Modern retail warehouse scheme consisting of 133,000 sq. ft.

- B&Q plus five terrace units, three A3 restaurant pods and a further A1 pod occupied by Carphone Warehouse.

Manchester Royal Exchange Acquisition

Royal Exchange | Manchester

A unique mixed-use investment opportunity

The Manchester Royal Exchange, first established in 1729 is a piece of Manchester’s

history and a reminder Manchester’s history as a great trading city.

The building is uniquely located on the boundary betweeen Manchester’s centre retail and businesss districts.

Our aqcuisition was only the second time in its history that it had been sold.

At the point of acquisition the asset had suffered decades of under investment and was generally considered low grade accommodation.

Applying our customer focused tests with investment we saw a completely type of asset, and the potential the reinvent it as a prime retail and office destination in central Manchester.

First Step Homes Launched

Launched First Step Homes in Ireland

Identifying an opportunity in the Irish residential market, Trinity Ireland was set up to deliver additional housing stock across the spectrum of tenures.

Our primary aim is to deliver high quality housing across Ireland. We create places for people to live, work and play.

Our approach combines quality materials and attention to detail, coupled with passion and innovative design to deliver a broad spectrum of homes, from 1 bedroom flats to 4 bedroom houses.

The Capital Building Acquisition

Acquired The Capital, Liverpool in joint venture with Starwood Capital

A unique building at the heart of Liverpool’s dynamic new business community

The Capital dominates Liverpool’s fast-evolving new commercial hub where the city’s businesses are forming a distinctive cluster in the style of Paris’s La Défense. Just minutes from the waterfront, town hall and new Liverpool One retail core, the commercial environment is becoming the key location for doing business in this exciting city. It affords everything a prestigious corporate location expects, already attracting Radisson SAS, Malmaison and other quality hotels along with countless stylish bars and restaurants.

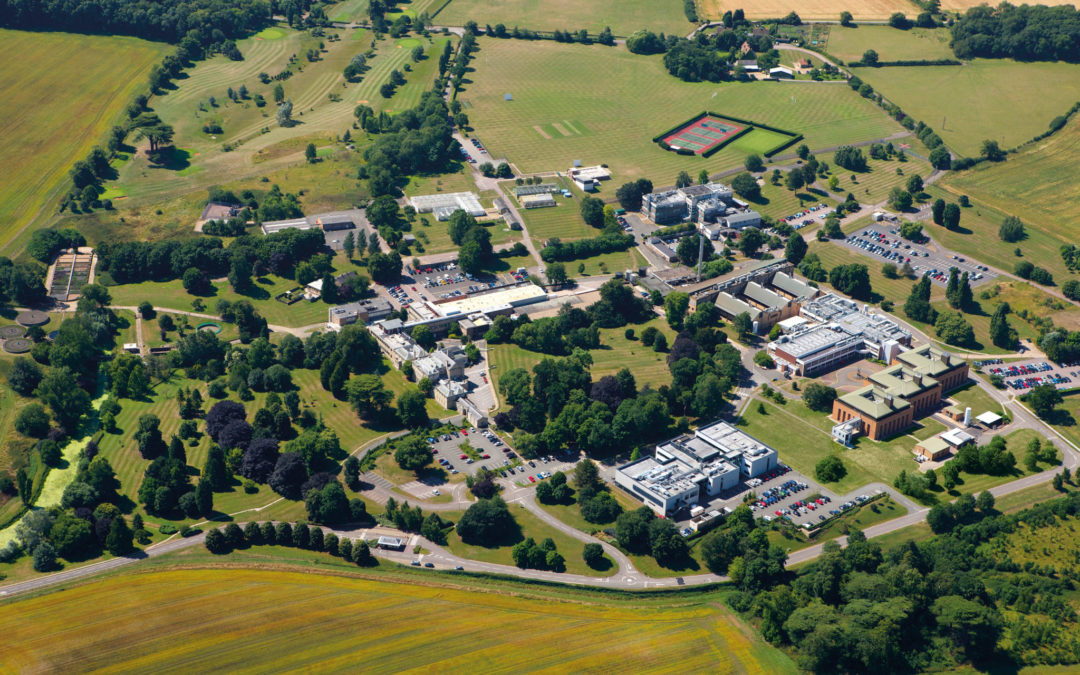

Science Parks Acquisition

Aquisition of the UK's largest private network of science parks

The portfolio, covers 348 acres across the five sites and is the largest privately owned network of science and technology parks in the UK.

Together with US investment manager Angelo Gordon and Trinity Investment Management closed on the £95 million purchase of Mars Pension Fund’s Business Environments for Science and Technology (BEST), a portfolio of five science parks situated across the UK.

We identified a unique opportunity for a under appreciated asset class which has historically proven to be recession proof and we felt had significant upside as a core part of the UK’s industrial strategy and benefits from substantial govermnent support.

Manchester Royal Exchange Sold

Sold to Hines following a £16m refurbishment

After decades of under investment under previous ownership, Trinity IM successfully implemented a complete overhaul of the building and helped to make it a new thriving retail and office destination in the centre of Manchester.

RETAIL

- Full upgrade and standardisation of retail signage

- Attracted new retailers: Watches of Switzerland and French Connection

- Cleaning of exterior

- New LED lighting

OFFICES

- Surrender of intermediary leasehold interest across 1/3 of the asset

- Complete refurbishment of offices to a Grade A specification

- Increased office entrance size by c. 100%

- Creation of roof garden overlooking Manchester

- Secured 80,000 sq ft letting to Clyde & Co

ARCADE

- Complete overhaul and refurbishment of arcade

- New LED lighting

- New Floor

- New illuminated bus board signs

- Tenant mix improvements to complement a premium atmosphere

Anglia Retail Park Sold

Sold to Ipswich Borough Council

Upon completing our business plan we were able to deliver an eclectic retail destination to the local community.

Over the business plan we transformed the asset by widening planning from restrictive bulky goods consent to include part Open A1. Doing so enabled us to leverage the Parks historical trading performance and place with the retail heirachy to secure an exciting new tenant line up. In total we secured 200,000 sq ft lettings to mainline occupiers on 10 year terms.

Expanded into our new offices

Moved into St Christopher’s Place

Following the aquisition of the science park portfolio, and to maintain our high level of service as asset managers our team expanded significantly. As part of this exciting growth phase we moved into our new offices to accommodate our growing team.

Knowledge Factory Launched

Launched Knowledge Factory, a UK focused innovation platform.

A network of science parks tailored to the UK innovation sector

Recognising the potential of STEM (Science, Technology, Engineering, Mathematics) innovation in the UK, Trinity IM launched the Knowledge Factory platform.

The Knowledge Factory was created to help foster collaboration and innovation between the businesses on our science parks, to make their occupation as easy as possible, and to provide investment support when needed.

Our three strategic aims

1. Fostering collaboration

We do this by providing the support and connections that businesses on our sites need to innovate

2. Making more time for science

We take care of the day to day real estate and facilities challenges so that our occupiers can focus on their core business

3. Assisting business growth

We assist in navigating the grants process, and connecting start-ups with seed capital, and when you’re ready we can also offer growth capital to help you achieve your potential.

Re-capitalised Knowledge Factory

Priviledged to partner with Harrison.

To build upon the previous 4-years with Angelo Gordon Trinity re-capitalised their science park portfolio with a global specialist investor, Harrison Street.

Colworth Park aquisition

Expanding the Knowledge Factory platform

Colworth is a centre for scientific excellence and the global R&D centre for Unilever, having been at the forefront of Unilever’s research for over 60 years.

Centred around the original 18th Century, Grade II Listed Colworth House, Colworth Park is set in 91 acres of rolling parkland on the edge of the village of Sharnbrook in Bedfordshire, and is home to a wide range enterprises, from start-ups to global corporations, focusing on food, health, medical devices, antibodies, sustainability, life sciences, green energy, planning and other sectors. Colworth provides a highly supportive campus culture where networking and collaboration between organisations is the norm.

Cardiff Edge Acquisition

Expansion of the WAPG portfolio

A regionally important science park achored by Citiva and NHS. The acquisition expands the portfolio to 9 assets UK wide.